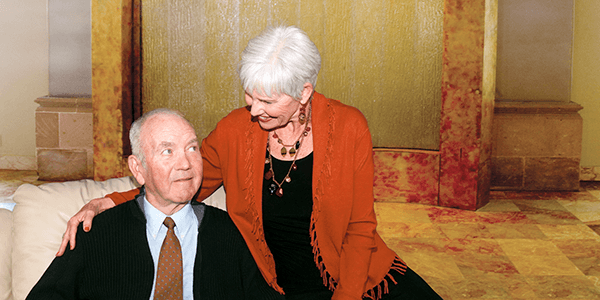

Laura and Scott purchased a life insurance policy many years ago to create security for their children's future. Their children are now adults with good jobs, and they have accumulated significant assets of their own. The insurance is no longer needed for its original purpose.

Laura: We wondered if there was any benefit to giving our policy to the Allentown Symphony Association since we no longer needed it.

Scott: I wasn't ready to part with the insurance just yet. I wanted to preserve the option of giving it to our family if someone needed extra help down the road. We both wondered if there was a way we could commit now to help the symphony but make our gift at a later date when it was clear the policy wouldn't be used.

Laura and Scott decided a bequest of insurance to the Allentown Symphony would help them achieve their personal and charitable goals. The bequest could be made by simply naming the Allentown Symphony Association as the beneficiary of their policy. With the beneficiary designation unchanged during life, the insurance proceeds would go to help our future work. Laura and Scott's estate could benefit from an estate tax charitable deduction based on the value of the proceeds paid.

Laura: The insurance bequest made sense to us.

Scott: I liked the fact that our estate would benefit from tax savings, which would help to preserve other assets intended for our family.

Creating a bequest of life insurance is an easy gift to establish. You can leave a life insurance policy to the Allentown Symphony Association if the policy is no longer needed for its intended purposes by completing a beneficiary designation form. If you have questions about bequests of life insurance, please contact us. We are happy to answer any questions you have.